Table of Content

"Be the most preferred and trusted financial institution serving the military and their families." Navy Federal Credit Union Mortgage promises that if you find a better rate with another lender, it will match it or give you $1,000. Read our full Navy Federal Mortgage review to find out if this might be the best lender for you. Navy Federal loses some points for having a relatively high amount of complaints compared to many other lenders and for not being clear about some of their requirements. Its important to have any car youre ready to buy inspected by a mechanic you choose.

For one, the lender can usually deposit the funds into your bank account on the same day . However, if you’d rather receive your funds in the form of a check, Alliant offers to mail you one. Within each category, we also considered several characteristics, including available loan amounts, repayment terms, APR ranges and applicable fees. We also looked at credit score requirements, whether the lender accepts co-signers or joint applications and the geographic availability of the lender.

Navy Federal Auto Loan Requirements

Origination fees.NFCU doesn’t charge origination fees. Once you become a member, you’re part of our family. We’re dedicated to providing you all the support you need to reach your financial goals along with the banking experience you deserve. It can make it easier to negotiate a better sales price and lets you know what you can afford. Once you pay the seller, ensure the title is received by Navy Federal within 90 days of purchase.

Finally, we evaluated NFUC’s support tools, borrower perks and features that simplify the borrowing process—like prequalification options and mobile apps. Make sure to acknowledge receipt of the Closing Disclosure by calling or emailing your loan officer as soon as you receive it. Property address at closing must match address used at time of application. Refinancing your existing car loan can be a good idea if youve improved your credit score or interest rates are significantly lower than when you initially took out the loan. Navy Federal Credit Union offers refinance auto loans for your vehicle.

Navy Federal Credit Union Mortgage is right for you if:

A home equity loan provides all the money upfront with reliable interest and a clear repayment period, youll know exactly where you stand with your loan. Because home improvement loans are unsecured, interest rates tend to be higher than those of secured loans. For instance, interest rates for home improvement loans range between 4% to 36%, whereas home equity loans interest rates range from 4% to 13%. A home improvement loan is a type of unsecured personal loan that can be used to finance home renovations, repairs and upgrades.

Navy Federal doesnt have a loan pre-qualification tool, so you have to undergo a hard credit inquiry to review your loan options, which can cause a small dip in your credit score. With First Tech, you can prequalify and view your rates without impacting your credit score. Navy Federals personal loans can be secured or unsecured. Its unsecured loans can be used for personal expenses or home improvements. Home improvement loans can have repayment terms as long as 180 months, but youll pay a higher APR for the longer terms. To serve members by answering SCRA & mortgage related inquiries and questions pertaining to Navy Federal mortgage products, loan and products.

Receive your loan check.

Or, you can use your existing NFCU savings or CD accounts as collateral for a secured loan at lower rates than you’ll find anywhere else. Mission Fed offers home equity loans with fixed rates and terms that fully amortize. That means you receive your money in one lump sum, use it as needed, and start repaying the loan right away with set monthly payments. Fixed interest rates help you calculate how much interest youll end up paying over the life of the loan. Navy Federal’s website displays sample interest rates for most of the mortgages it offers, along with annual percentage rates.

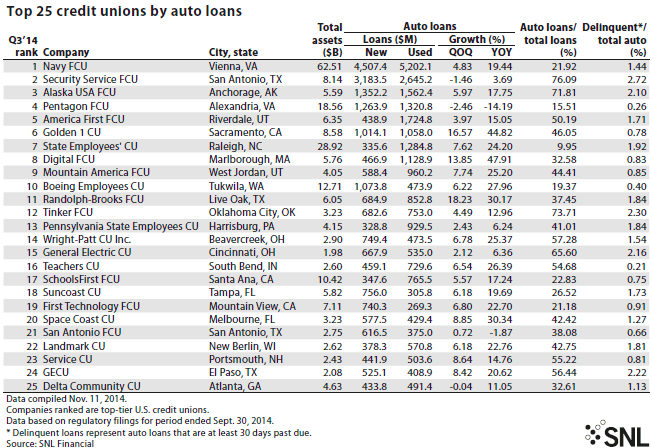

Funds can be used for a variety of expenses including medical, debt consolidation, and home improvements. NerdWallet's ratings are determined by our editorial team. Navy Federal Credit Union, like other credit unions, offers low auto loan rates. The catch is that you must be a member in order to qualify for them. Eligible members will find a range of options at Navy Federal, whether youre interested in a new, used or even classic car or refinancing a vehicle you already have.

One advantage of personal loans from the lenders above? Theyre unsecured, so you wont risk losing your home, and dont require a closing process, so you can get your money fast. If youre happy with the rates and terms that NFCU offers you, go ahead and sign the agreement. If youre not happy with the offer, you dont have to accept the loan.Receive the money. The quickest way to receive your funds is through an automatic deposit, which you can receive immediately after approval.Repay the loan.

After you submit your financial information, Navy Federal tells you how much you're eligible to borrow, pending approval. You can use this information to learn how much house you might be able to afford, or to show sellers you are serious about buying. During pre-approval, however, the terms are not set. It's only after you choose a property that NFCU performs a more comprehensive review of your application and makes a firm offer. Navy Federal offers fantastic starting rates on their auto loans and its a good option whether you need a small or large loan, however, you have to qualify for the loan.

If your original mortgage was not with NFCU, the refinance rate may be slightly higher than the rate offered to customers refinancing Navy Federal mortgages. If you're a member of the armed forces or a Department of Defense employee , take a look at Navy Federal Credit Union Mortgage. NFCU caters to service members and their families with special products and programs that promote homeownership.

Before submitting an application, always verify all terms and conditions with the offering institution. Checking your rate with Navy Federal will affect your credit score. They will conduct a hard, not soft, credit inquiry . In 2022, Navy Federals lowest available fixed rate for new loans has increased 15.1% while its highest fixed rate has declined 8.1% . The lowest available variable rate is up 100.6% and the highest starting variable rate has increased just 1.3% . The following two lenders arent Credible partners, so you wont be able to easily compare your rates with them on the Credible platform.

Navy federal auto loan pre approval is the perfect credit union which offers auto loans pre approval you could use to negotiate a better sales price with the dealer. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions.

Your credit score is a major factor in determining what mortgage interest rate you receive. It's to your benefit to improve your credit before you apply. PNC Bank offers a wide range of mortgages and special homeownership grants for qualified applicants. PNC's pre-approval is fully underwritten -- so if you are approved, PNC is making a firm commitment to lend under those terms.

No comments:

Post a Comment