Table of Content

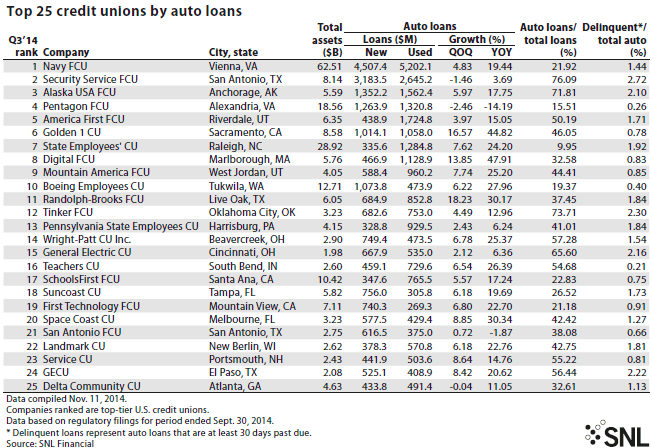

Navy Federal Credit Union primary credit card holders get a FICO® Score for free -- just enable the feature while you log into your account. A Navy Federal Credit Union auto loan or auto refinance loan can be a good choice for those who qualify for membership. Credit union members can take advantage of low APRs and lengthy loan terms. If youre not in the armed services or part of a military family, youll need to look elsewhere for a loan to finance your vehicle purchase. The first step is to decide whether you need a home improvement loan. If youd rather borrow against the equity in your home, you can look into a home equity loan or a home equity line of credit.

Once you decide to apply for your mortgage, you’ll need to provide documents verifying information listed on your application. It’s helpful to start gathering these details and items so they're ready when you need them. A preapproval lettershows sellers you're a serious buyer and gives you a competitive advantage when you decide to make an offer on a home. Visit HomeSquad to request your preapproval letter from Navy Federal. Permissible loan purposes for extended term loans include home improvements and the purchase of land, airplanes, fully self-contained recreational vehicles, and boats. Call or visit a branch for additional information.

VA Mortgage Rates2

Our partners cannot pay us to guarantee favorable reviews of their products or services. The main difference between the two is the purpose of the loanwhether its for debt consolidation or personal expenses. With a debt consolidation loan, the requested loan amount is based on the existing loan balances youre looking to consolidate.

‡Investment products and services are available through Navy Federal Investment Services and are not insured by NCUA. +Rates are based on an evaluation of credit history, so your rate may differ. NFCU is very hard to beat when it comes to home loans. That said, you can't get a loan here if you're not a member, and not everyone will qualify for membership. NFCU's mortgage rates are rock bottom and tend to be lower than the national average.

Featured Products

Although the approval process is long and arduous, the company can help you secure the car loan you want with reasonable APRs. Rates vary depending on your credit score and the value of your vehicle. Generally, newer vehicles receive better rates than older ones, but the company does offer loans for all types of cars. Vehicles must be within 20 years old and have a clean title.

Or, you can use your existing NFCU savings or CD accounts as collateral for a secured loan at lower rates than you’ll find anywhere else. Mission Fed offers home equity loans with fixed rates and terms that fully amortize. That means you receive your money in one lump sum, use it as needed, and start repaying the loan right away with set monthly payments. Fixed interest rates help you calculate how much interest youll end up paying over the life of the loan. Navy Federal’s website displays sample interest rates for most of the mortgages it offers, along with annual percentage rates.

Sac Federal Credit Union Login

Be sure the loan check is completed and signed when you're ready to purchase your vehicle. Rates are based on creditworthiness, so your rate may change. Home Improvement Loan rates range from 7.49% to 18.00% APR. Personal Loan rates range from 7.49% to 18.00% APR. Your funds will be automatically deposited into your account in as little as 24 hours.

• When submitting your pre-appointment request, you will need to enter your information, your desired loan amount, and your credit score so that Navy Federal can approve you first. I figure this scenario will be adequate to get their lowest 72 month rate of 2.29%. Will they have any probably with this loan, given I am increasing my monthly obligations from $2,000 to $2,700?

To refinance your car with Navy Federal, you must take out a loan thats at least $5,000. Term limits and APRs for refinancing are the same as those for new and used auto loans. Navy Federals personal loans are an especially good fit for members with fair credit who want to fund a home improvement project. If denied, the best course of action is to inquire as to the reason for denial of your application. Perhaps you can make changes to your application, such as the loan amount or payment terms. If not, then at least you know how to improve your application.

Visit our VA homeownership hub to learn more about the application process. This promotion is not a commitment to lend, nor a guarantee that you will be approved for a mortgage from Navy Federal Credit Union. Promotion cannot be combined with other promotional incentives or credits except for Special Freedom Lock, Guaranteed Rate Match, and RealtyPlus. HomeSquad provides a one-stop resource for all your mortgage management needs. Whether you’re gathering information, crunching the numbers or preparing to fill out your application, we have the tools and resources you need. We have a loan option for you and special features to make sure you get a great deal.

If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Navy Federal Credit Union offers personal loans between $250 to $50,000 to its members. Because it’s a credit union, you must be an active member to be eligible for one of its loans or other financial products. Membership is limited to people who have an eligible connection with the military. Before you start the mortgage process, check your credit report for errors. Some errors affect your credit score, so correct any discrepancies you find when you review your credit history.

A wide selection of loans with low or no out-of-pocket costs plus the free rate lock and rate match guarantee make Navy Federal hard to beat. Navy Federal Credit Union's mortgage rates trend lower than the national average. If you qualify for NFCU membership, Navy Federal mortgage might be the best deal in town. Even if you don't qualify for the lowest advertised rate, mortgages from Navy Federal are a great deal. Include this credit union when you research options. Navy Federal Credit Union Mortgage offers home buyers pre-approval without a commitment to lend.

We are very disappointed and demand a refund of the $48 credit report that was never used or disclosed prior to starting the application process . Similarly, NFCU doesn’t disclose its minimum income requirements, but it does take this into consideration. NFCU will also look at your past banking history with it as well, so this could be one benefit of establishing a relationship with NFCU before borrowing money.

A home equity loan provides all the money upfront with reliable interest and a clear repayment period, youll know exactly where you stand with your loan. Because home improvement loans are unsecured, interest rates tend to be higher than those of secured loans. For instance, interest rates for home improvement loans range between 4% to 36%, whereas home equity loans interest rates range from 4% to 13%. A home improvement loan is a type of unsecured personal loan that can be used to finance home renovations, repairs and upgrades.

I am about 60 days away from applying and want to make sure I have all eventualities covered, including more money down if necessary. Before you can apply for a personal loan from Navy Federal, you have to become a member. Department of Defense, veterans, and their families.

If circumstances arise that make it difficult for you to keep up with your mortgage payments, there are a variety of programs that may be available to help. Direct Deposit Send funds directly to your account to ensure seamless deposits while you're deployed or traveling. The Ultimate Certificate Strategy Laddering your certificates is an excellent way to ensure you earn the best rates possible.

No comments:

Post a Comment